TYPES OF SIP ( SYSTEMATIC INVESTMENT PLANS )

UNDERSTAND THE CONCEPT OF SIP AND HOW IT WORKS

PUNEET LAKRA

11/11/20244 min read

1. Regular SIP

Description: You invest a fixed amount regularly at a specific frequency (e.g., monthly or quarterly).

Example:

Amount: ₹5,000

Frequency: Monthly

Mutual Fund: Equity Fund A

Investment Duration: 10 years

Every month, ₹5,000 is automatically deducted from your bank account and invested in the chosen mutual fund. Over the years, you accumulate units at varying market prices, benefiting from rupee cost averaging.

2. Flexible SIP

Description: You can change the SIP amount at any time, depending on your financial situation.

Example:

Month 1: Invest ₹5,000

Month 2: Increase to ₹7,000

Month 3: Decrease to ₹3,000

Month 4: Pause the SIP

This flexibility allows you to adjust the amount you invest based on your income or expenses. For instance, if you receive a bonus in Month 2, you can increase the contribution, and if you face a financial strain in Month 3, you can reduce it.

3. Top-Up SIP (Step-up SIP)

Description: You increase your SIP amount periodically, typically annually, by a fixed amount or percentage.

Example:

Initial SIP Amount: ₹5,000 per month

Step-up Amount: ₹1,000

Frequency of Step-Up: Annually

Year 1: ₹5,000

Year 2: ₹6,000

Year 3: ₹7,000

Over time, your SIP amount increases, helping you keep up with inflation or rising income. After 5 years, your SIP might have grown to ₹9,000 per month, even though you started with ₹5,000.

4. Perpetual SIP

Description: An SIP that continues indefinitely until you decide to stop it.

Example:

Amount: ₹5,000

Frequency: Monthly

Mutual Fund: Balanced Fund B

This SIP runs perpetually, meaning every month ₹5,000 will be deducted from your account and invested until you decide to stop it. There’s no predetermined end date. You might choose to stop or change it when you achieve your financial goal, like retirement or buying a home.

5. Fixed Date SIP

Description: You specify a particular date every month for the SIP to be deducted.

Example:

Amount: ₹10,000

Date: 5th of every month

Mutual Fund: Large Cap Fund C

You choose to invest ₹10,000 on the 5th of each month. If your salary is credited on the 1st, you might prefer this date for automatic deduction to align with your cash flow.

6. Weekly SIP

Description: You invest a fixed amount every week, usually in smaller amounts.

Example:

Amount: ₹1,000

Frequency: Every week

Mutual Fund: Equity Fund D

Every week, ₹1,000 will be automatically deducted from your account and invested. This results in 4 investments in a month, and you get more opportunities to benefit from market fluctuations.

7. Dividend SIP

Description: You choose to reinvest the dividends earned from your mutual fund back into the same or a different mutual fund scheme.

Example:

Amount Invested: ₹50,000 in an Equity Fund

Dividend Earned: ₹2,500 (annually)

Reinvestment Option: You choose to reinvest the ₹2,500 dividend back into the same fund every year, instead of withdrawing it.

Over time, this can lead to compounding, as your investment grows not only with your SIP but also with the reinvested dividends.

8. Smart SIP

Description: A smart SIP automatically adjusts the contribution or invests more in specific market conditions, typically using technology or AI to track market movements.

Example:

Amount: ₹5,000

Frequency: Monthly

Based on market conditions, the smart SIP might increase the investment amount by ₹1,000 during market dips or reduce the contribution when markets are volatile, in order to maximize returns while minimizing risk.

9. SIP with Lock-in Period (ELSS SIP)

Description: You invest in an Equity Linked Savings Scheme (ELSS), which offers tax benefits under Section 80C, but has a 3-year lock-in period.

Example:

Amount: ₹3,000 per month

Mutual Fund: ELSS Fund E

Tax Benefits: You will get a tax deduction of ₹3,000 under Section 80C each year, but your investment will be locked in for 3 years. After 3 years, you can redeem or switch the fund.

10. Goal-Based SIP

Description: This SIP is designed to achieve a specific financial goal, like saving for a child’s education, a down payment on a home, or retirement.

Example:

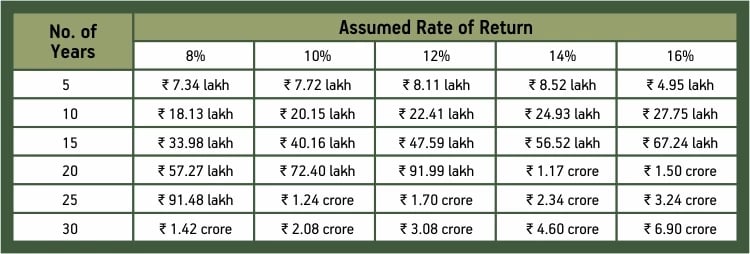

Goal: Saving ₹10 Lakhs for a child’s education in 15 years

SIP Amount: ₹6,000 per month

Mutual Fund: Balanced Fund F

By calculating the target amount and time frame, you can decide the SIP amount that will help you achieve your goal. In this case, ₹6,000 per month is expected to grow to ₹10 Lakhs over 15 years, assuming a 12% annual return.

11. Instalment SIP

Description: You invest a lump sum amount but choose to spread it across several smaller SIPs.

Example:

Lump Sum Investment: ₹60,000

SIP Instalment: ₹5,000 per month for 12 months

You invest ₹60,000 in a mutual fund, but instead of investing the entire amount at once, you break it into 12 monthly SIP instalments of ₹5,000 each, over the next year. This can help reduce market timing risk.

12. Rupee Cost Averaging SIP

Description: An SIP where you invest a fixed amount regardless of the market conditions, which helps average out the purchase cost of units over time.

Example:

Amount: ₹5,000 per month

Market Conditions:

Month 1: Unit price ₹100

Month 2: Unit price ₹90

Month 3: Unit price ₹110

By investing ₹5,000 each month, you buy more units when the price is low (Month 2) and fewer when the price is high (Month 3), reducing the average cost per unit over time.

These examples illustrate how each SIP type works and how they cater to different investor preferences, financial goals, and market conditions. The key benefit across all types of SIPs is the discipline and long-term compounding effect, regardless of the market's short-term fluctuations.

LINK FOR SIP CALCULATOR YOU CAN CHECK : https://sipcalculator.in/

TO START YOUR INVESTING JOURNEY CLICK ON THIS LINK https://www.wealthy.in/p/punee47179 OR CONTACT US.

Investments

Expert financial planning and investment advisory services.

Insurance

Funds

+917428692137

© 2024. All rights reserved.